Table of Contents

- Bmw Championship 2025 Tee Times - Minna Sydelle

- 2025 Small Business Tax Deductions Checklist - Blog - Akaunting

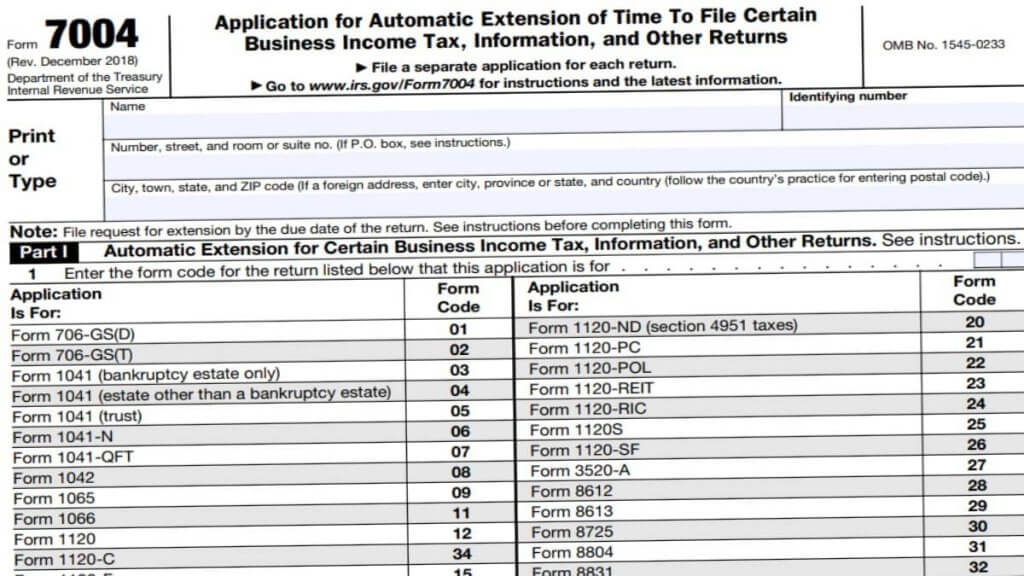

- Tax Deadline 2024 Extension Form 2024 - Meade Jocelyn

- Key 2021 tax deadlines & check list for real estate investors - Stessa ...

- Income Tax Calculator | EE Tax 2025

- Essential Tax Preparation Checklist For 2024 Excel Template And Google ...

- Income Tax Prep Checklist | Free Printable Checklist | Tax prep ...

- Configurations For 2025 Land Rover Range Rover - Ray Leisha

- Streamline Tax Preparation With 2024 Tax Preparer Checklist Excel ...

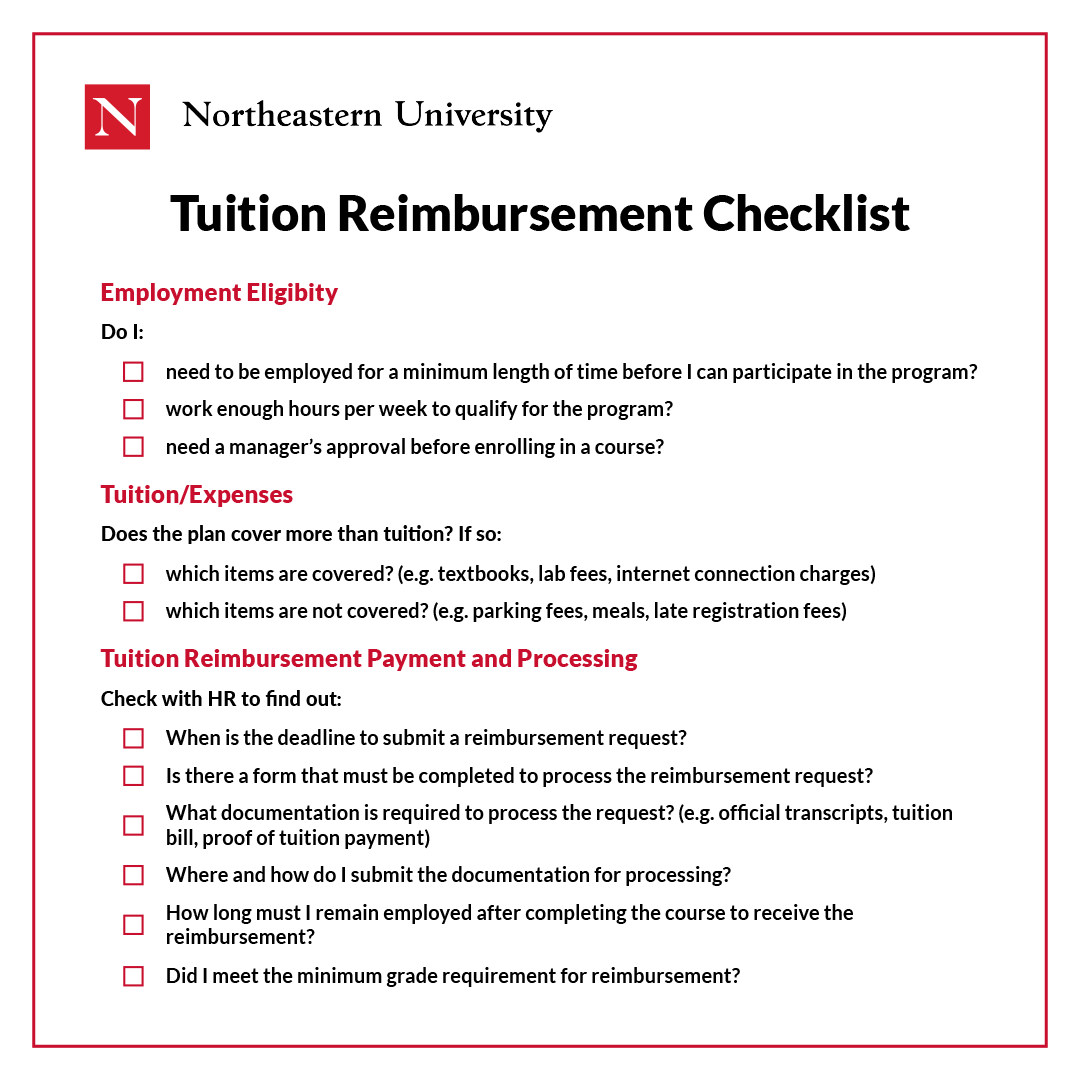

- Fedex Tuition Reimbursement 2025 - Liuka Shannon

Why Gather Documents?

- Accurate Tax Filing: Providing accurate information is vital to avoid errors, audits, or even penalties.

- Maximize Refund: Gathering all the necessary documents can help you claim the maximum refund you're eligible for.

- Reduce Stress: Having all the documents in one place can reduce stress and anxiety during the tax filing process.

Documents to Gather

- Income Documents:

- W-2 forms from your employer

- 1099 forms for freelance or contract work

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Deduction Documents:

- Receipts for charitable donations

- Medical expense receipts

- Mortgage interest statements (1098)

- Property tax statements

- Credit Documents:

- Child care expense receipts

- Education expense receipts

- Retirement account contributions

Tips for Staying Organized

- Create a Folder: Designate a folder or file to store all your tax-related documents.

- Scan Documents: Scan your documents and save them digitally to reduce clutter and make them easily accessible.

- Use Tax Software: Utilize tax software like TurboTax or H&R Block to guide you through the filing process and ensure accuracy.

By following this guide, you'll be well-prepared to tackle the tax filing process with confidence. Stay organized, and you'll be on your way to a stress-free tax season.