Table of Contents

- VOO vs. VOOV vs. VOOG - Vanguard S&P 500, Value, or Growth?

- Vanguard 500 Index Fund (VOO) Stock Price, News, Quote & History ...

- VOO VS SPY - Which S&P 500 ETF Is Better? — The Market Hustle

- VOO Stock Fund Price and Chart — AMEX:VOO — TradingView

- VOO Stock Price and Chart — AMEX:VOO — TradingView

- VOO letter logo design on white background. VOO creative circle letter ...

- Voo Stock, Vanguard S&P 500 Etf, Voo Stock Analysis, Voo News, Voo ...

- Vanguard S&P 500 ETF Trade Ideas — AMEX:VOO — TradingView

- VTI vs VOO: A Comparison of Two Vanguard ETFs

- VOO介紹:美股報酬最佳的ETF!慢慢變富的最好選擇,報酬以及風險分析 - 懶人經濟學

When it comes to investing in the stock market, one of the most popular and widely-tracked indices is the S&P 500. The Vanguard S&P 500 ETF (VOO) is an exchange-traded fund that allows investors to track the performance of this index, providing broad diversification and potentially lower risk. In this article, we'll delve into the details of the Vanguard S&P 500 ETF, its stock price, and the latest news, as well as provide insights from The Motley Fool.

What is the Vanguard S&P 500 ETF (VOO)?

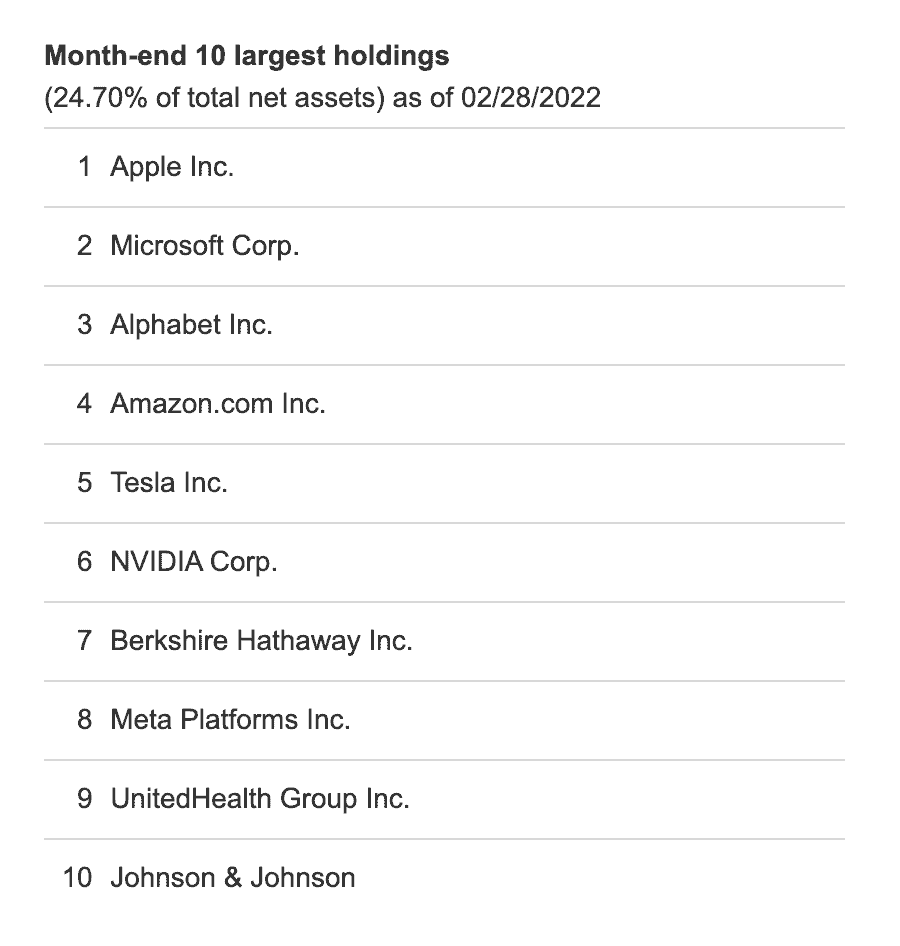

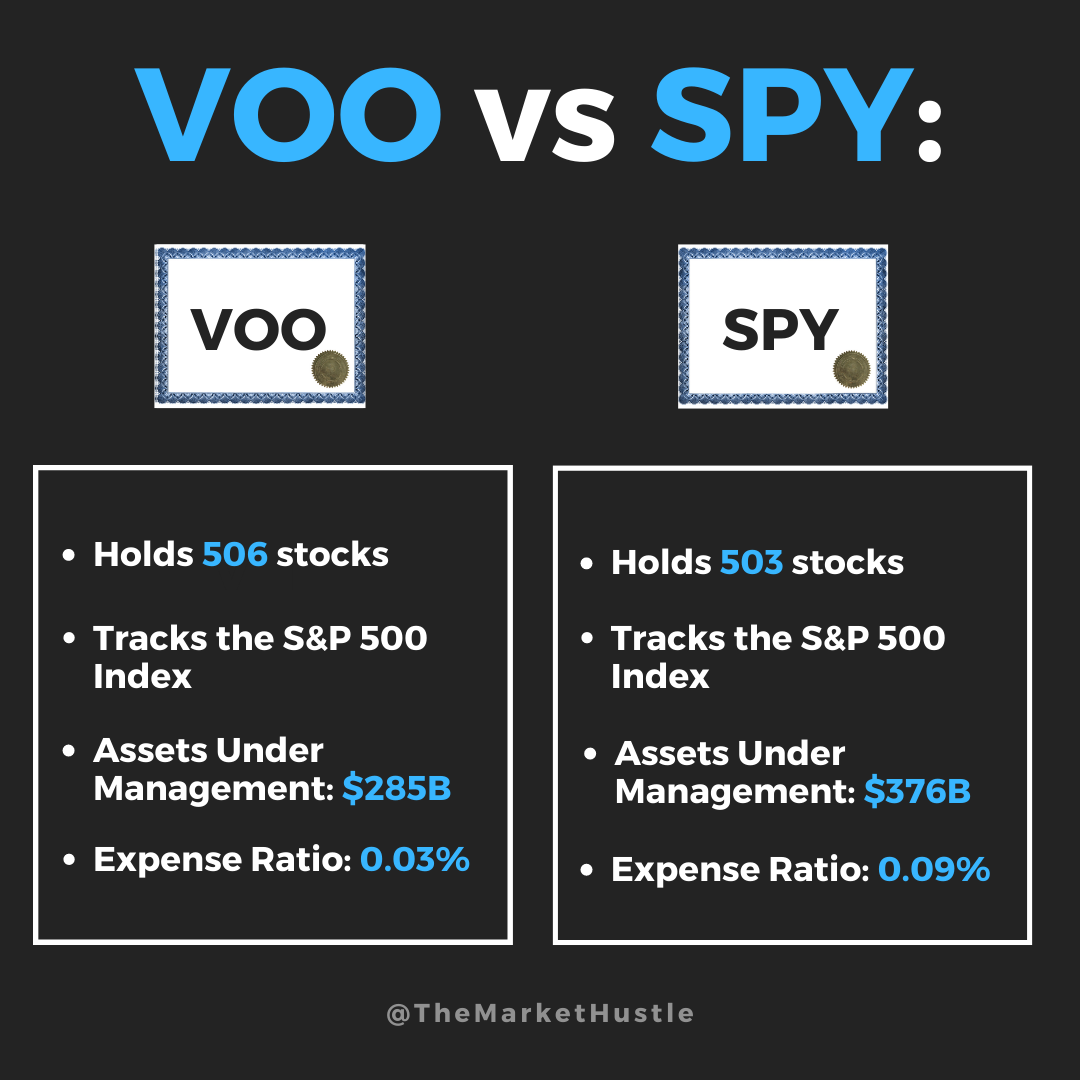

The Vanguard S&P 500 ETF (VOO) is an exchange-traded fund that tracks the performance of the S&P 500 Index, which is a market-capitalization-weighted index of the 500 largest publicly traded companies in the US. The fund is designed to provide investors with broad diversification and exposure to the US stock market, making it a popular choice for those looking to invest in a single fund.

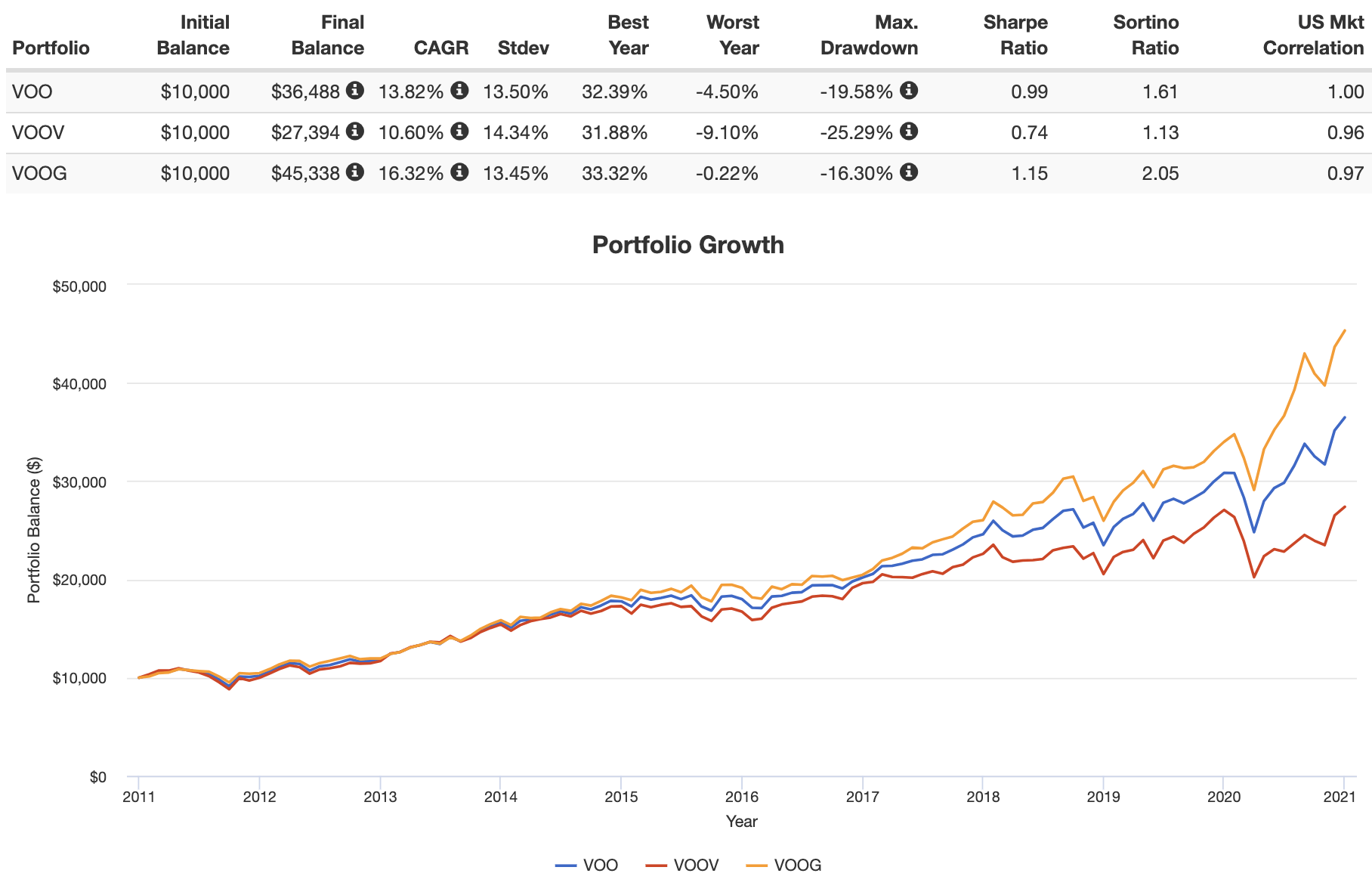

Stock Price and Performance

The stock price of the Vanguard S&P 500 ETF (VOO) can be found on various financial websites, including The Motley Fool. As of the latest update, the stock price of VOO is around $340 per share. The fund has a long history of strong performance, with a 10-year average annual return of around 13%. However, it's essential to note that past performance is not a guarantee of future results, and investors should always do their own research and consider their individual financial goals and risk tolerance before investing.

News and Updates

According to The Motley Fool, the Vanguard S&P 500 ETF (VOO) has been a top performer in recent years, with a strong track record of consistent returns. The fund's low expense ratio of 0.04% makes it an attractive option for investors looking to minimize costs. Additionally, the fund's diversified portfolio and broad market exposure make it a great choice for those looking to reduce risk and increase potential long-term returns.

Benefits of Investing in VOO

There are several benefits to investing in the Vanguard S&P 500 ETF (VOO), including:

- Diversification: By tracking the S&P 500 Index, VOO provides investors with broad diversification and exposure to the US stock market.

- Low Costs: The fund's low expense ratio of 0.04% makes it an attractive option for investors looking to minimize costs.

- Consistent Returns: VOO has a long history of strong performance, with a 10-year average annual return of around 13%.

- Convenience: The fund is listed on major stock exchanges, making it easy to buy and sell shares.

In conclusion, the Vanguard S&P 500 ETF (VOO) is a popular and widely-tracked exchange-traded fund that provides investors with broad diversification and exposure to the US stock market. With its low expense ratio, consistent returns, and convenience, VOO is an attractive option for investors looking to invest in a single fund. For the latest news and updates on VOO, be sure to check out The Motley Fool. As with any investment, it's essential to do your own research and consider your individual financial goals and risk tolerance before investing.

By investing in the Vanguard S&P 500 ETF (VOO), you can potentially benefit from the long-term growth of the US stock market, while minimizing risk and costs. Whether you're a seasoned investor or just starting out, VOO is definitely worth considering as part of your investment portfolio.